Should You Implement A Wellness Program In Your Small Business?

We’ve all heard of wellness programs and how big companies promote them, however, these companies may be on to something. Enabling a workplace wellness program provides many benefits: reduced stress, greater productivity, increased morale, and reducing health insurance costs (if one is offered). There is a common practice in most businesses around the country of individuals working until they burn out. It is very important that businesses small and big provide their employees different “outlets” that promote a healthy lifestyle. Small business employees tend to wear multiple hats, so employees may not want to take time off as they are dedicated to what they do and may not want to return to a stack of work.

Wellness programs can provide multiple positive outcomes. By providing activities that help reduce stress, create higher productivity, and improve morale, this is great for not only your employees but also you as an employer. A study done in 2019 stated that “wellness p...

To Vaccinate or Not To Vaccinate... that is the question.

As we all know, the hot topic for the past year has been COVID-19. Recently the conversation has turned from doom and gloom to hope and excitement for the future. Something as simple as the possibility of hugging someone special or walking into a public place without a mask is infusing life back into our community. I know I am bursting at the seams as I look forward to the upcoming summer. Full disclosure, I may hug the first person who steps on my toes as I push through a crowded room.

As we watch the COVID numbers decrease and the vaccination numbers increase, the small business community is eager to do our part. Supporting community vaccinations in our businesses through optional or mandatory vaccination policies has brought a ton of questions to the table. Below are a few questions that we have been able to help the small business community navigate.

Q: Required Vaccinations vs. Recommended Vaccinations…what should I consider?

A: There are many pros and cons to weigh ...

Colorado Mandates Employee Paid Sick Leave for All

We knew this was going to continue to be a big year for legislation and it just keeps on coming. Be sure to follow our HR Branches Facebook as we will be going live to discuss these legislative changes now as well as in the future. Feel free to submit your questions in advance by emailing [email protected] or giving us a call at 719-244-9640.

Without further adieu, lets dive in shall we?

The federal mandate FFCRA (Families First Coronavirus Response Act) we reported on a few months ago was just the shallow end of the pool. Get your life vest- this isn't a kiddie pool folks, the "Healthy Families and Workplaces Act" is white water rapids for the small business community. Carefully navigating these treacherous waters to keep your business afloat is going to be crucial.

On July 14, 2020 Colorado Govenor, Jared Polis signed the "Healthy Families and Workplaces Act" into law. In the state of Colorado, only 60% of employees have paid time off through their employer. While this bill...

Become a Germ Slayer (Coronavirus Prep in the Workplace)

Updated: March 17, 2020

The Coronavirus has been making headlines over the past two months. Now that this bug has hit US soil, the buzz is much greater and scarier. The media is telling us to run for cover and self-quarantine and buy up all of the toilet paper and bleach wipes you can find (hint: there are still some bleach wipes at Home Depot). Outside of the media, people are torn, we hear a ton of information, but we are unsure of what to believe.

As you are reading this blog we are seeing more and more forced closures. Ski resorts, restaurants, gyms, and other public gathering locations have already experienced forced closures. Unfortunately, we are seeing the likeliness of more and more closures. Small business are going to feel a tremendous impact today and in the long-term future. Taking precautions and making plans now, will help to minimize the impact. Who knows what the fallout will be, but it's time to prepare for the worst.

Here are a few things to consider when...

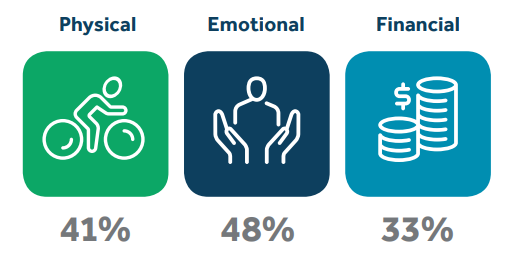

Workforce Well-Being...Not So Well

Like most Americans, small business workers want less stress and better work-life balance

Guest Post by Clint Perry at Unlimited Benefits

% Rated excellent/very good health by small business workers

The well-being of 60 mill...

Small Business? Group Benefits? No Way!

This is the usual reaction I find when a small business of twenty employees or less is approached about employee health, dental or vision benefits.

Many believe it’s too expensive. Well, it may be. But too expensive for who? The employer? I think not. The employee, maybe, but let the employee decide that for themselves. Offering benefits can only enhance an employer’s image to recruits regardless of the expense to either side.

Employee benefits, in the last five years, have become much less stringent on the rules regarding what an employer must contribute, how much paperwork an employer must complete and who can enroll, save for the ACA guideline regarding husband and wife groups but we’ll get to that later.

In today’s benefit marketplace many carriers have relaxed the regulations regarding employer contributions to be so minimal it allows for any employer to at least make a benefit offering. For example, Anthem Blue Cross Blue Shield, here in Colorado, requires no contribu...

6 Things Small Businesses Need to Know About HIPAA Compliance

6 Things Small Businesses Need to Know About HIPAA Compliance

If your small business deals with sensitive patient/client information, then you're going to want your staff to be well versed in HIPAA laws and regulations. Here are 6 things you need to know about HIPPA compliance and your team.

In your role, you have access to plenty of sensitive information. Your colleagues are trusting you to keep it safe. But what does the law say about privacy rights?

One of the most highly protected types of information is health-related data. Some HR records only contain scattered pieces of health information in employees' employment records, like sick notes and workers' compensation claims. Others small businesses that use a self-insured method to pay for employees' medical expenses have much more information.

How much of this information is protected by HIPAA, Health Insurance Portability and Accountability? The information below will help you abide by HIPAA compliance laws.